Master Financial Data Analytics

Join our comprehensive 9-month program starting September 2025. Learn from industry veterans and build real-world skills in financial modeling, data visualization, and market analysis.

Reserve Your SpotBuild Skills That Actually Matter

Financial markets move fast. The tools and techniques you learn here aren't theoretical – they're what professionals use every day to analyze market trends, build forecasting models, and make data-driven decisions.

Our September 2025 cohort focuses on practical application. You'll work with real datasets, learn from people who've spent years in the field, and build a portfolio that demonstrates actual competency.

- Hands-on experience with Python, R, and SQL for financial data

- Real market data analysis and visualization projects

- Direct mentorship from working financial analysts

- Portfolio development with genuine industry examples

- Small cohort sizes for personalized attention

Three Learning Tracks

Choose your focus area based on where you want to take your career. All tracks include core fundamentals plus specialized depth.

Data Analytics Foundations

Master the fundamentals of financial data analysis. You'll learn to clean datasets, build visualizations, and create reports that actually communicate insights. Perfect if you're transitioning from another field or want to strengthen your analytical foundation.

Financial Modeling

Go deeper into predictive modeling and quantitative analysis. Build Monte Carlo simulations, time series forecasts, and risk assessment models. This track assumes some prior experience with data analysis or finance.

Market Analytics

Focus on market behavior, trading algorithms, and investment analysis. Learn to process real-time data feeds, backtest strategies, and understand market microstructure. Best for those interested in trading or investment research.

Learn From People Who Do This Work

Our instructors aren't just teachers – they're working professionals who use these skills in their daily roles at investment firms, fintech companies, and data consultancies across Australia.

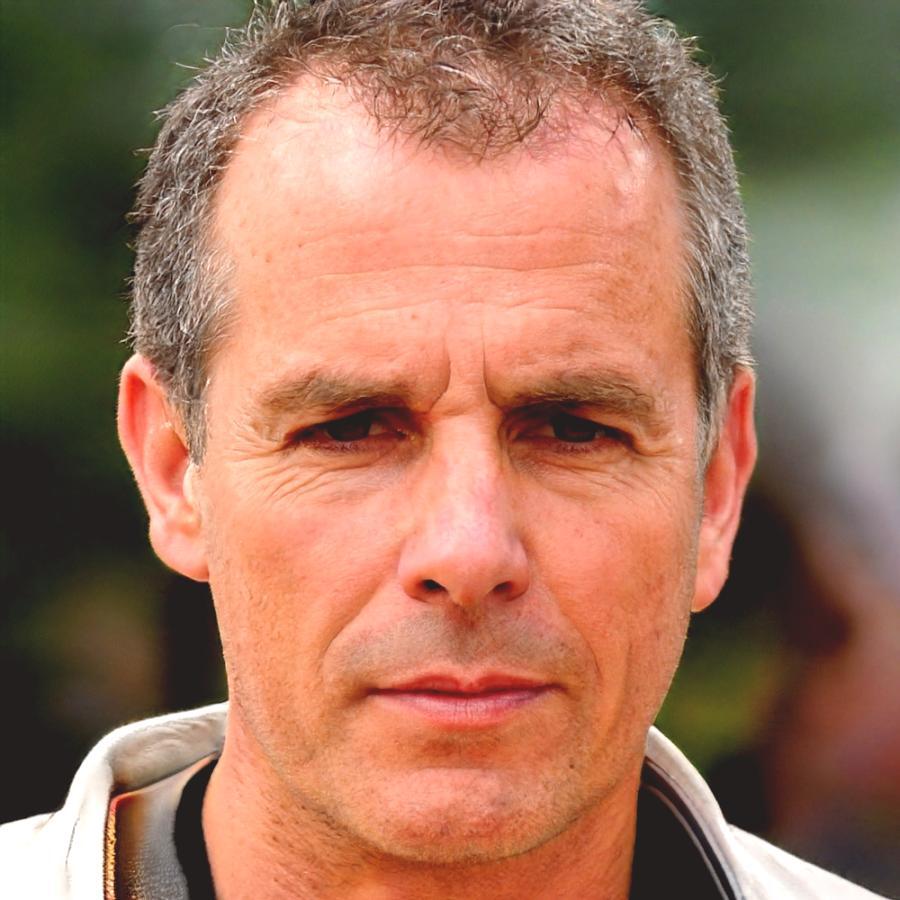

Kieran Blackwood

Spent eight years building risk models for institutional investors. Kieran teaches our advanced modeling modules and brings real examples from hedge fund work. His approach focuses on understanding when models work and when they don't.

Zara Tremaine

Former investment banker turned data scientist. Zara leads our foundations track and specializes in making complex concepts accessible. She's particularly good at helping career changers build confidence with technical skills.

Nyx Ashford

Runs market analytics for a major Australian asset manager. Nyx brings institutional-level insights to our market analytics track. Her expertise in alternative data sources gives students exposure to cutting-edge techniques.

Emberly Vaughn

Built data infrastructure for multiple fintech startups before going independent. Emberly handles our technical workshops and helps students understand the business context behind the analytics work they're learning.